Many years ago, I worked for a hedge fund in the heart of Belgravia. I was exhausted from working for one of the biggest investment banks, and I wanted the opportunity to work in a different smaller environment, where I can learn more about the business, and in a speedier manner.

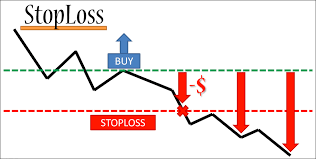

It was a matter of few weeks before this tribe of experts all cuddled in one floor became my sanctuary of knowledge. I had worked with traders from every desk trading every asset class you can think of. Hedging their trading risks were the risk managers, the people I was spending my days in the job supporting as a Risk Technology Analyst. Here I learnt the inside and outs of techniques, methodologies, and tools that successful trading relies on to avoid losing money. You see the trader would focus on optimising profits from transactions, and the risk manager makes sure that money earned will not be lost. One of these techniques they used to ensure this was the concept of the Stop Loss line. This elegant and simple idea means you set a level or a threshold that if reached you cease your trading. In simpler words, think of it as if you are investing in a stock, when you purchase your stock you set a limit on your loss, for example, set the stop loss line at 10% of the price you bought the stock for. If the stock’s price would ever fall below that 10%, you sell it immediately, hence limiting your loss to 10%.

This is done in financial risk management to size, limit, and contain the maximum loss and protect the investment should the sh*t hits the fan. When I realised the power of this simple concept, I couldn’t help but think that you must hand it to the financial industry in monetary management. After all, these people deal with millions of dollars in transactions. They have to protect the investors’ wealth, their bonuses, and the company’s survival and competitive edge. It’s a win-win-win for everyone. And I can ensure you from experience that a good portion of the best creative minds in London mostly sit designing ways to make money and protect it. For this reason, it is certainly wise to follow the genius of the financial industry and apply these efficient strategies they had expensively designed to protect what is most dear to us, not just our money.

I kept thinking to myself what if I had a stop loss line to mitigate the risk of loss in anything I care about. I started unconsciously finding myself thinking about stop loss lines in every situation where I needed a well-defined strategy to exit or cut my losses where I know that self-control might be compromised under emotion and temptation. You see, in finance, when you invest in a stock, you can get emotionally attached to it, you dream about it raising in value and making you a fortune. And though business is not meant to be ‘personal’, it usually is. This is just the nature of us humans, we get attached, whether we like it or not. And when your stock’s price starts falling, you might keep telling yourself that it will be ok, it will bounce back, that you should hang into it a bit more while its value starts increasing again, you obsess about it even though you see it keeps falling in value. Then the more you lose, the more you keep hoping – or rather convincing yourself – that you will win again, except that in the market’s reality you might never do, and the fact that you didn’t get rid of that stock earlier is now a massive loss that has a bigger dent on your wealth and possibly ego. It is for this emotional attachment that a stop loss line is perfect enforcement to self-control. The red line will show on your face if you breach that 10% you have set before your got attached to that stock.

So why not set stop loss lines everywhere an ‘uncontrollable’ loss can occur. I wanted to shock-proof my life, have a plan to minimise my losses, and affirm my decisions where unwanted emotions can interfere in my objectivity to handle certain situations. So, I set a stop loss line for my weight, one for my finances, and even one for my relationships. I go on diet if I cross 65kg in weight – no questions asked, regardless of the temptations, that is my limit. I do not borrow more than £5000, if I reach this amount in debt, I cut off everything but the human necessities I require, basically food and bills. And where most useful, if a romantic potential didn’t look promising after 3 dates, it would be over, no negotiation, no further analysis, no talking myself into giving more chances, and most definitely no regrets, for the stop loss line has spoken.

Of course, for this to work, you need to choose stop loss lines that work for you, after all you know yourself best, and we are each unique in our personalities, strength and weakness, self-awareness, values and boundaries, decision making, and attitude to risk. What might work for me, might not work for you.

What would you do to mitigate the risks in your life? To ensure yourself more peace and assert self-control where weakness can creep in and drives you to unwanted loss. Would you set a stop loss line?